Ira Limit 2025 Income - Traditional And Roth Ira Contribution Limits 2025 Jody Rosina, The total contribution limit for iras in 2025 is $7,000. Your child's income must be below a certain threshold to contribute to a roth ira. What Are The Ira Limits For 2025 Margo Sarette, Ira contribution limit increased for 2025. For 2023, the total contributions you make each year to all of your.

Traditional And Roth Ira Contribution Limits 2025 Jody Rosina, The total contribution limit for iras in 2025 is $7,000. Your child's income must be below a certain threshold to contribute to a roth ira.

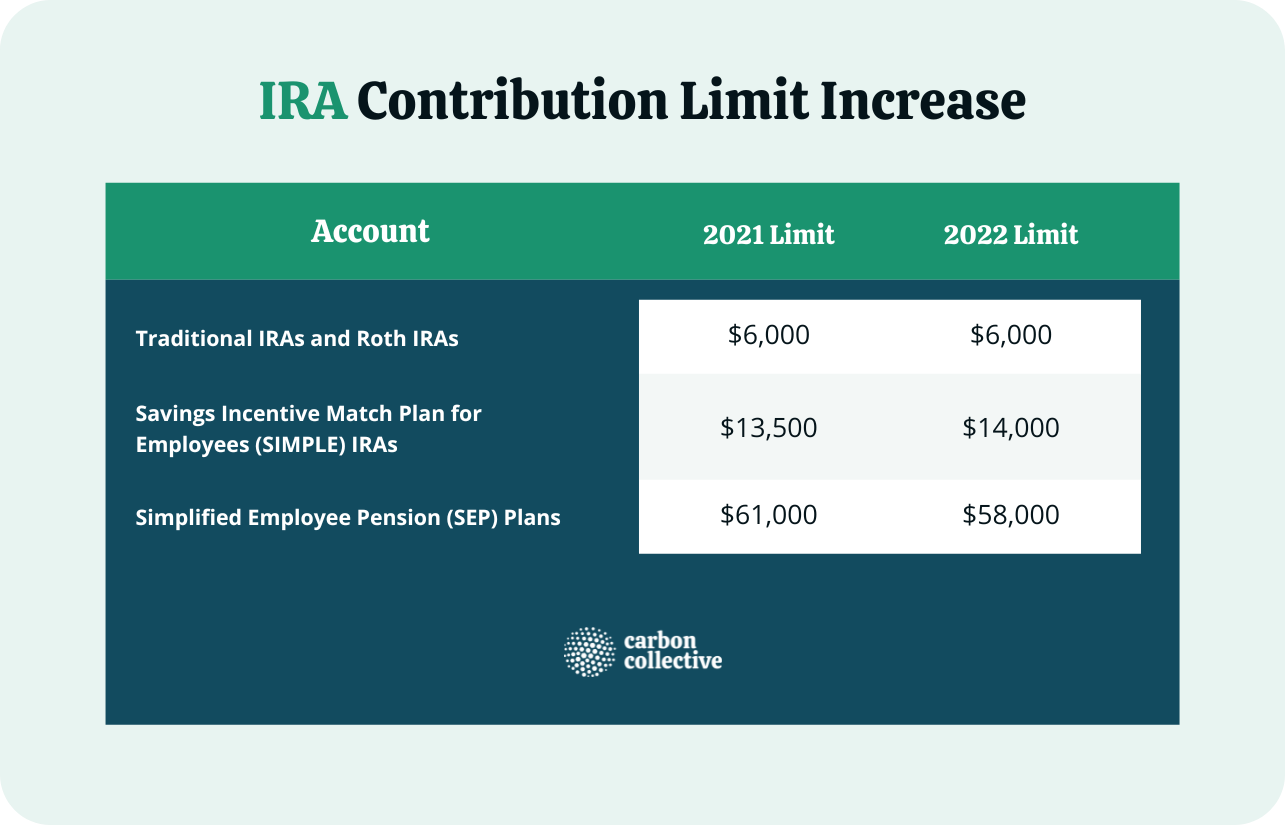

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. Written by lauren perez, cepf®.

For 2025, you can contribute up to $7,000 in your ira or.

The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

ira contribution limits 2025 Choosing Your Gold IRA, This figure is up from the 2023 limit of $6,500. In 2025, your magi has to be under $146,000 for single filers or under $230,000 for joint filers to make the full roth ira contribution of $7,000 (or $8,000 if you're 50 or older).

2025 Roth Ira Limits Phase Out Beckie Rachael, Anyone with earned income can contribute to a traditional ira, but your income. Roth ira income limits for 2023 and 2025.

IRA Contribution and Limits for 2023 and 2025 Skloff Financial, Updated on december 22, 2023. Anyone with earned income can contribute to a traditional ira, but your income.

Roth 401k 2025 Limits Davine Merlina, Roth ira contribution and income limits 2025. According to the fidelity ® q2 2023 retirement analysis, roth iras are.

Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

IRS Unveils Increased 2025 IRA Contribution Limits, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025. For 2025, if you are married and filing jointly, each spouse can make a maximum roth ira contribution of $7,000 if they have an agi (adjusted gross income).

IRA Contribution Limits in 2025 & 2023 Contributions & Age Limits, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. The roth ira income limits are less than $161,000 for single.

This limit is subject to the annual roth ira contribution. For 2023, the total contributions you make each year to all of your.

Roth IRA 2025 Contribution Limit IRS Rules, Limits, and, According to the fidelity ® q2 2023 retirement analysis, roth iras are. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older.